|

|

|

Select your vehicle to see available coverage options:

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Auto Repair Insurance Cost: A Comprehensive Coverage GuideAuto repair insurance is an essential consideration for many U.S. consumers looking to protect themselves from unexpected vehicle repair costs. Understanding the costs and benefits of such insurance can help provide peace of mind and financial security. What is Auto Repair Insurance?Auto repair insurance, often referred to as an extended auto warranty, covers the cost of certain repairs after the manufacturer's warranty expires. This insurance can be a lifesaver when it comes to expensive repairs, providing both financial relief and peace of mind. Types of Coverage

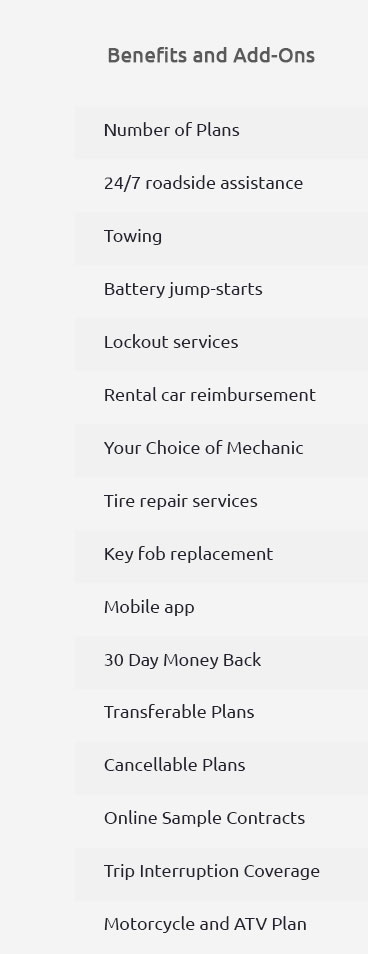

Cost FactorsThe cost of auto repair insurance varies based on several factors, including the make and model of the vehicle, its age, mileage, and the level of coverage desired. In cities like Los Angeles and New York, where living costs are higher, premiums may be more expensive, but the potential savings can also be significant. Comparing CostsWhen evaluating car service insurance, consider these factors:

Benefits of Auto Repair InsuranceInvesting in auto repair insurance offers several benefits, including:

FAQsConclusionAuto repair insurance is a smart investment for U.S. vehicle owners seeking to mitigate the risks of costly repairs. Whether you live in bustling New York or sunny Los Angeles, having this protection can save you both money and stress. Explore options like vehicle replacement insurance to further enhance your coverage. https://pogo.co/auto-repair-shop-insurance/cost/

There are several affordable auto repair shop insurance quotes you want to look at, such as liability, property, garagekeepers, and workers' comp for mechanics. https://www.vantagepointrisk.com/blog/auto-repair-shop-insurance-cost/

Auto repair shop insurance costs vary based on multiple factors such as location, size of the business, number of employees, and the services you offer. https://clovered.com/car-repair-insurance/

The average cost of car maintenance insurance is about $100 per year to add this coverage to your standard full coverage policy. However, the cost doesn't end ...

|